Boat Insurance Eligibility

Author: Michael Hiller | 10 min Read

In Australia, there are a few requirements you will need to meet in order to qualify for boat insurance. These requirements may vary depending on the specific policy you choose.

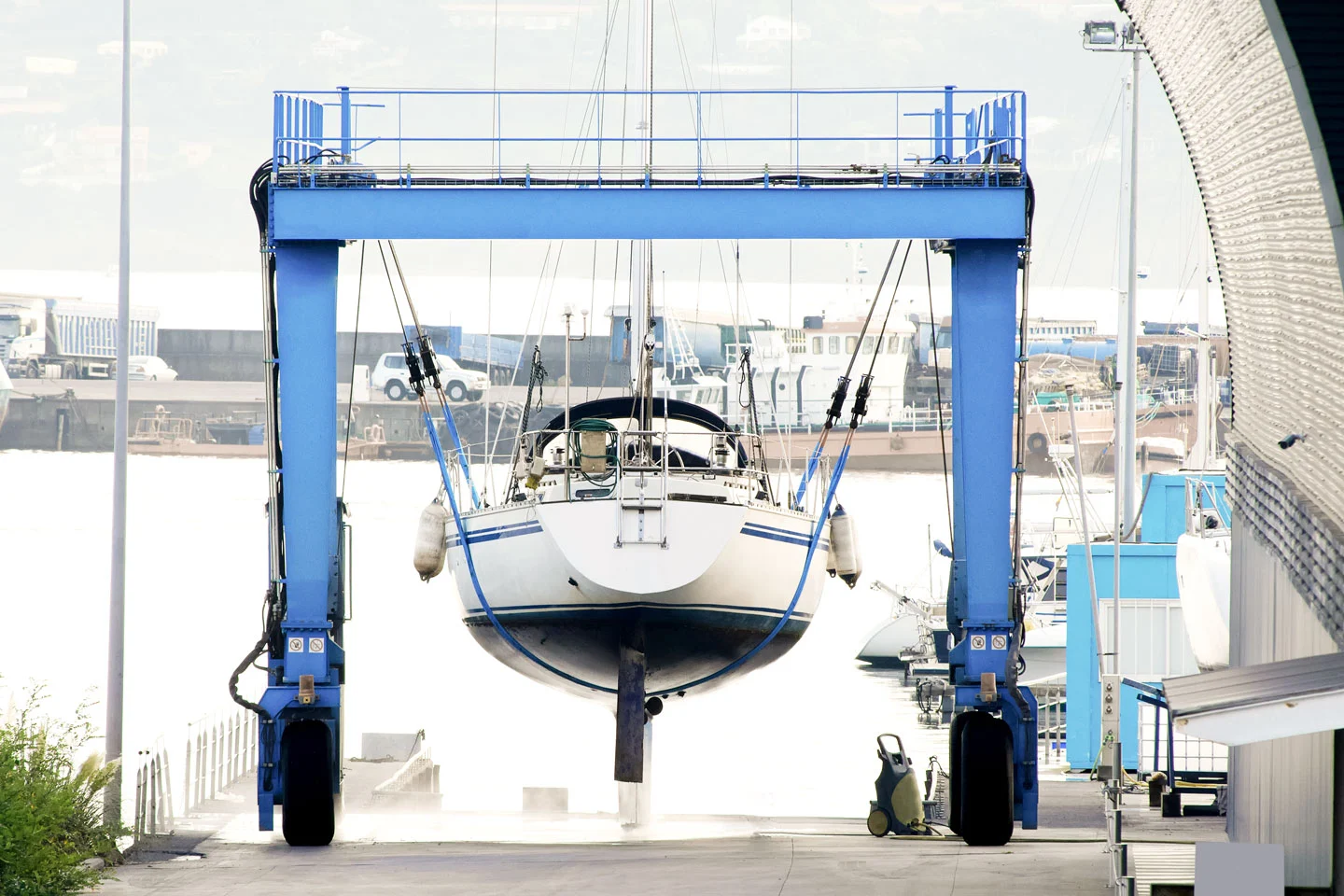

Seaworthiness and Insurance: Ensuring Safety and Coverage for Your Boat

Seaworthiness is an important consideration when it comes to boat insurance. Seaworthiness refers to a boat's ability to safely navigate the water and withstand the normal conditions of the sea. A seaworthy boat is one that is in good repair and has all the necessary safety equipment and features to operate safely on the water.

Seaworthiness is an important factor in boat insurance, as insurance policies typically require that a boat be seaworthy in order to be covered. If a boat is not seaworthy, it may be more prone to accidents or damages than insured against, and insurers may be unwilling to provide coverage.

Meeting Insurance Policy Requirements

As a responsible boat owner, it is crucial to maintain your vessel in good repair and equip it with all the necessary safety equipment and features to meet the requirements of your comprehensive boat insurance policy. By adhering to these guidelines, including having items such as life jackets, fire extinguishers, navigation lights, and other essential safety gear, you can ensure that your boat is seaworthy and compliant with your insurance policy's standards. This proactive approach not only safeguards you and your vessel but also ensures that you remain eligible for coverage in the event of any unforeseen incidents.

A Seaworthy vessel has all the necessary safety equipment onboard

When is a Survey Report Needed?

While a survey report may not be mandatory to obtain boat insurance, it is highly recommended to have one conducted for your peace of mind. Investing in a survey report can provide crucial information regarding the condition and value of your boat, allowing you to identify any underlying issues that may require attention. This knowledge empowers you to make informed decisions about maintenance and usage, ultimately ensuring the safety of your vessel and mitigating the risk of uninsured events. Having a comprehensive understanding of your boat's condition through a survey report is a proactive measure to protect your investment and navigate any potential challenges with confidence.

A survey report can provide valuable information about the condition and value of your boat

Insurance Provider Guidelines: Navigating Boat Surveys for Older Boats

When it comes to obtaining boat insurance, one of the main factors that may trigger the need for a boat survey is the age of the vessel. As boats age, the likelihood of issues arising from wear and tear or inadequate maintenance increases. Insurance companies often require a boat survey to evaluate the condition and value of an older boat. This assessment helps determine the appropriate level of coverage and premium costs for insuring the vessel. It's important to keep in mind that the specific survey requirements can vary among insurance providers and policies. To ensure compliance, it is recommended to consult with your insurance provider to understand the specific survey requirements for obtaining coverage for your boat.

During a boat survey, a qualified marine surveyor will thoroughly inspect various aspects of the vessel, including its structural integrity, mechanical systems, electrical components, and safety features. The surveyor will assess any existing damage, potential risks, and the overall seaworthiness of the boat. The survey report provides valuable information to the insurance company, helping them assess the insurability of the boat and set appropriate coverage terms. By conducting a boat survey, insurance providers can ensure they have accurate information about the condition of older boats, reducing the potential for disputes or claims related to pre-existing damage.

In summary, if you own an older boat and require insurance coverage, it's essential to be aware of the potential requirement for a boat survey. Check with your insurer to understand their specific guidelines and the scope of the survey. By complying with these requirements, you can facilitate a smoother insurance process and ensure that your older boat is properly protected against unforeseen risks on the water.

There are several other reasons why a boat survey may be required for obtaining boat insurance, including:

- The requested sum insured value being significantly different to the purchase price

- The boat type and usage

- High performance vessels, including carbon fibre built boats

- A recently purchased boat

- Extensive modifications or alterations made to the boat

- Age of the boat exceeding a certain threshold

- Previous insurance claims or history of damage

- Offshore or long-distance cruising intentions

- Insuring a boat with a high-value or rare model

- Insuring a boat with a history of mechanical or structural issues

Navigating Boat Insurance Policy Hurdles

If you notice you are struggling to get boat insurance for your vessel, you are not alone. Obtaining boat insurance can be a challenging process, especially if you have a poor driving record or an older boat. However, there are a few steps you can take to try and secure coverage:

- Review the requirements: Make sure you understand the specific requirements for boat insurance, including any age or ownership requirements, and other eligibility criteria.

- Check with multiple insurance companies: Different insurance companies may have different eligibility requirements and may be willing to provide cover for your boat. Shop around and get quotes from multiple insurance providers to see what options are available.

- Address any issues: If you are denied coverage or offered high premiums due to issues such as a poor driving record or an older boat, try to address these issues in order to improve your chances of securing coverage. For example, you may be able to improve the seaworthiness of your boat by making necessary repairs or upgrades.

- Consider alternative options: A higher excess may improve your chances of securing coverage. Another option you may want to consider is accepting lower coverage, such as third party only coverage.

- Obtain a Survey Report: Obtaining a professional marine survey and addressing any issues that are discovered can be a helpful step to take.

Overall, if you are struggling to get boat insurance, it is important to carefully review the requirements and consider all your options in order to secure the coverage you need.

Like What You Have Read? Share It With A Friend

WANT TO KNOW MORE

Check out the New Wave Marine online quote tool to see if you are eligible for boat insurance

Explore Blog categories

Want to receive the latest news and boating advice?

We offer a convenient newsletter subscription service that delivers the latest updates to your inbox. To sign up, visit our website and enter your email address in the subscription box. It's quick, easy, and free, and you'll be the first to know about any new products or services we offer

Thanks for signing up!